MoneyPlan$: Budget, Personal F 0.0.4

Free Version

Publisher Description

MoneyPlan$: Budget, Personal F - Stick to a budget, Manage Credit, Save Money

MoneyPlan$ users increase their monthly savings, improve their credit score, and advance their budgeting techniques.

KEY FEATURES UNIQUE TO MONEYPLAN:

50-70/10/20 Budgeting Rule: Money Plans automatically divides your after tax income to allocate up to 70% to spend on your needs, 10% on credit card payment acceleration and 20% for savings

Tailored Financial Advice: Get access to customized advice and guidance to help you prioritize, make spending decisions, paydown debt and credit faster, and learn financial discipline.

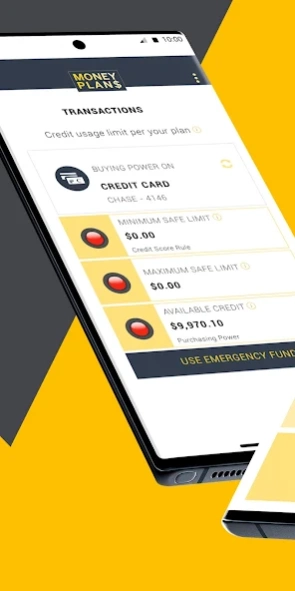

Credit Cards Risk Mitigation: Get total control of your credit cards: control your credit card usage and choose to accelerate either the credit card balance payment or your savings goals realization.

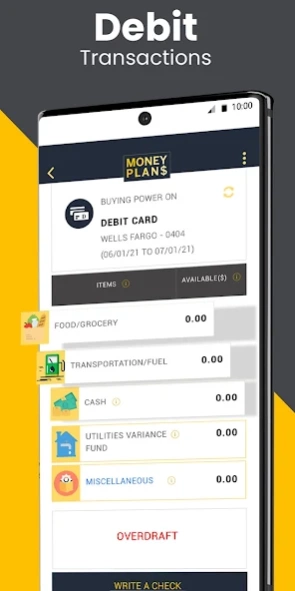

Write a Cheque: The Write a Cheque feature helps account for cheque transactions before the cheque is posted to your account. It shows how your cheque spending affects your budget and savings ahead of time.

Emergency Fund Management: Record, manage and keep track of your emergency fund usage

Cash Needs Fund: A monthly amount scheduled in the budget categories to cover future debit card cash withdrawal needs and keep a balanced budget.

Utility Bills Variance Fund: For utility accounts not enrolled in budget-billing, MoneyPlan will cover the gap with the utility bill variance budget category; the fund will help keep a balanced budget should a bill comes higher than planned.

Money Score: Measure how well you’re staying on track with your recurring budget and spending.

Innovative Reporting: Detailed, innovative spending and trend reports unique to MoneyPlan, help you measure progress and improve.

Financial Advice Easy to Interpret: MoneyPlan uses color coding and dollar amounts to guide your spending and savings behaviors

One-time setup: Setup your budget and forget it.

Flexible Subscription Plan: Decide how long you want MoneyPlan to accompany you in your savings journey: you can choose between 3 to 18 months subscription plan.

OTHER KEY FEATURES:

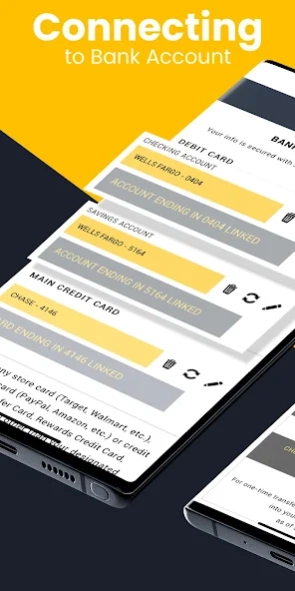

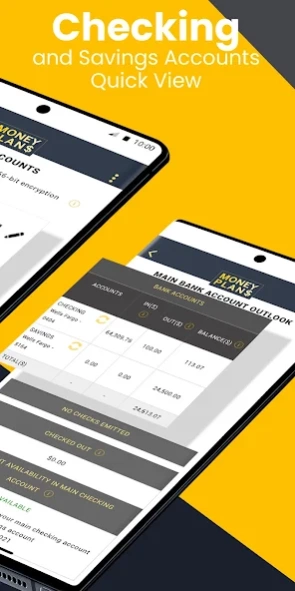

Bank Synching: The app will import your transactions to provide you with up-to-date financial advice.

Goal Tracking: Set unlimited funding goals and see when you'll be able to reach them.

On the Go: Real time access to financial advice to make good spending decisions wherever you are.

HOW TO USE MONEYPLAN:

1- Plan ahead: Before you go shopping, fill up your gas tank, dine out, make a payment on a credit card, or send money to a friend, check your MoneyPlan app to know just how much you can spend.

2- Open the app: Depending on what you’re planning to do, open the app to the related page: Transactions, Credit Re-Payment or Budgeting.

3- Read the advice customized for you: Based on your budget and financial information, MoneyPlan uses color coding and dollar amounts to guide your spending and savings behaviors.

4- Act on the advice: To benefit from the MoneyPlan$ app, you will need to conform your spending and saving behaviors to the MoneyPlan advice tailored around your budgetary goals.

5- Be MoneyPlan-disciplined: Resist the temptation to spend outside MoneyPlan$ guidance. Always consult the app before spending and read and act on the advice tailored for you.

6- Save money: Follow all of these steps and watch your savings grow and your financial goals materialize.

7- Readjust: When life changes, make adjustment to your budget and financial information and follow the first 6 steps to keep saving.

Download our app for free and sign up for our $5 monthly subscription. FIRST 2 MONTHS FREE. CANCEL ANYTIME .

SUBSCRIPTION DETAILS:

MoneyPlan$ offers flexible subscription plans between 3 to 18 months. CANCEL OR RESET PLAN ANYTIME . Plan is not auto renewable.

Payment is charged at the beginning of each period for the duration of the plan.

About MoneyPlan$: Budget, Personal F

MoneyPlan$: Budget, Personal F is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops MoneyPlan$: Budget, Personal F is MoneyPlan$. The latest version released by its developer is 0.0.4.

To install MoneyPlan$: Budget, Personal F on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2020-04-14 and was downloaded 2 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the MoneyPlan$: Budget, Personal F as malware as malware if the download link to com.app.moneyplans is broken.

How to install MoneyPlan$: Budget, Personal F on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the MoneyPlan$: Budget, Personal F is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by MoneyPlan$: Budget, Personal F will be shown. Click on Accept to continue the process.

- MoneyPlan$: Budget, Personal F will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.